Textbook econ: Why has inflation been so low?

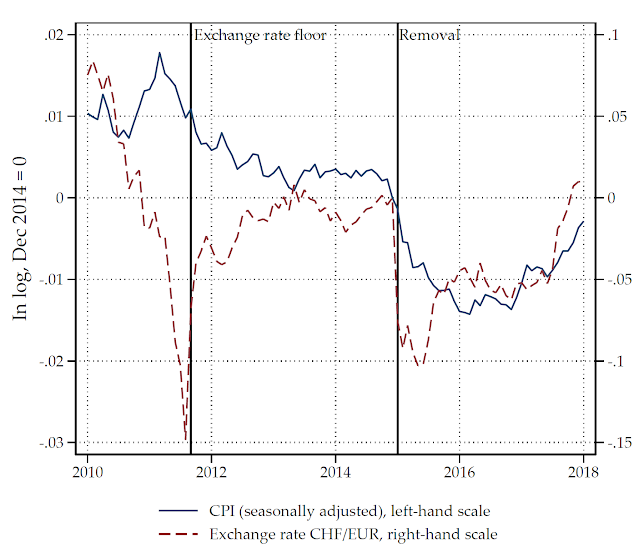

Inflation is low in Switzerland. At the same time, the monetary base increased massively because the SNB bought foreign assets in the course of its foreign exchange interventions. Sometimes, it is suggested that the two observations (an expanding monetary base and low inflation) are at odds with what we would expect from textbook economics.

It turns out that standard monetary theory actually predicts that large increases in the monetary base will not lead to higher inflation in the current environment (see for example, Krugman, Obstfeld, Melitz, International Economics: Theory and Policy, 10th Global Edition).

To see this, it is useful to first explain why monetary policy has an impact on real activity and inflation in normal times. The typical simple story goes as follows: As long as short-term nominal interest rates are positive, an increase in the money supply relative to money demand will lower the short-term nominal interest rate. This "liquidity effect" stems from the assumption that consumers prefer holding money, that yields a zero interest rate, relative to bonds, that yield a positive interest rate, because of the "liquidity services" it provides. That is, we can actually buy a coffee with a 5-franc piece, but, Starbucks will probably not accept a government bond (even with a short time to maturity). If the central bank supplies more money, the public will use at least part of the newly supplied money to invest in interest bearing bonds because they do not need all of the additional money for transaction purposes. Because the demand for bonds increases, bond prices rise, and thus nominal interest rates fall. Because the price level adjusts more slowly than the nominal interest rate, the real interest rate declines as well and stimulates the economy because of a lower real cost of borrowing. Firms invest more and hire more workers. As the labor market becomes tighter, workers demand higher wages and therefore firms try to raise their output prices. The result is an increasing price level: inflation.

Why is the current situation different? Recall that interest rates on Swiss government bonds are extremely low. For example, the 10-year government bond yield is essentially zero. In this situation the public becomes indifferent between holding money and investing in bonds. If money is actually more useful to fund transactions than bonds, and both yield a zero interest rate, the money supply can rise by a large amount without lowering the nominal interest rate further. Normally, the interest rate is lowered because the public reshuffles part of its money holdings in bonds as they earn a positive interest rate. However, why should the public invest its money holdings in bonds if money yields the same (or a higher) return as bonds? This is a situation we call a "liquidity trap". The central bank can thus expand the money supply but the nominal interest rate does not respond. As a consequence, the real interest rate does not change and therefore even large increases in the money supply does not stimulate the economy and does not lead to higher inflation.

What is the textbook solution in such a situation? The central bank has to convince the public that the increase in the money supply is permanent. If the central bank can credibly promise a higher money supply down the road (and this is a big "if") the public expects higher future inflation and therefore reduces the future expected real interest rate. In standard dynamic monetary models, however, this will affect consumption already today as consumers are forward-looking individuals. If the public thinks that the increase in the money supply will be reversed in the future, inflation expectations, as well as, the future expected real interest rate remain unchanged. Again, a temporary expansion of the monetary base has next to no effect.

Despite the massive expansion of the monetary base, there is little reason to expect that the Swiss National Bank plans to expand the money stock permanently. Should prices start to rise more quickly I am convinced that they will reduce the monetary base. Indeed, the increase in the monetary base occurred to a relevant extent while the SNB defended the exchange rate floor. It is important to remember that they discontinued the floor stating that it was an "exceptional and temporary measure" (my emphasis).

The textbook story may be too simple, it may be wrong, it may be too "Keynesian". However, checking the textbook sometimes reveals that what we observe is actually not so puzzling.

It turns out that standard monetary theory actually predicts that large increases in the monetary base will not lead to higher inflation in the current environment (see for example, Krugman, Obstfeld, Melitz, International Economics: Theory and Policy, 10th Global Edition).

To see this, it is useful to first explain why monetary policy has an impact on real activity and inflation in normal times. The typical simple story goes as follows: As long as short-term nominal interest rates are positive, an increase in the money supply relative to money demand will lower the short-term nominal interest rate. This "liquidity effect" stems from the assumption that consumers prefer holding money, that yields a zero interest rate, relative to bonds, that yield a positive interest rate, because of the "liquidity services" it provides. That is, we can actually buy a coffee with a 5-franc piece, but, Starbucks will probably not accept a government bond (even with a short time to maturity). If the central bank supplies more money, the public will use at least part of the newly supplied money to invest in interest bearing bonds because they do not need all of the additional money for transaction purposes. Because the demand for bonds increases, bond prices rise, and thus nominal interest rates fall. Because the price level adjusts more slowly than the nominal interest rate, the real interest rate declines as well and stimulates the economy because of a lower real cost of borrowing. Firms invest more and hire more workers. As the labor market becomes tighter, workers demand higher wages and therefore firms try to raise their output prices. The result is an increasing price level: inflation.

Why is the current situation different? Recall that interest rates on Swiss government bonds are extremely low. For example, the 10-year government bond yield is essentially zero. In this situation the public becomes indifferent between holding money and investing in bonds. If money is actually more useful to fund transactions than bonds, and both yield a zero interest rate, the money supply can rise by a large amount without lowering the nominal interest rate further. Normally, the interest rate is lowered because the public reshuffles part of its money holdings in bonds as they earn a positive interest rate. However, why should the public invest its money holdings in bonds if money yields the same (or a higher) return as bonds? This is a situation we call a "liquidity trap". The central bank can thus expand the money supply but the nominal interest rate does not respond. As a consequence, the real interest rate does not change and therefore even large increases in the money supply does not stimulate the economy and does not lead to higher inflation.

What is the textbook solution in such a situation? The central bank has to convince the public that the increase in the money supply is permanent. If the central bank can credibly promise a higher money supply down the road (and this is a big "if") the public expects higher future inflation and therefore reduces the future expected real interest rate. In standard dynamic monetary models, however, this will affect consumption already today as consumers are forward-looking individuals. If the public thinks that the increase in the money supply will be reversed in the future, inflation expectations, as well as, the future expected real interest rate remain unchanged. Again, a temporary expansion of the monetary base has next to no effect.

Despite the massive expansion of the monetary base, there is little reason to expect that the Swiss National Bank plans to expand the money stock permanently. Should prices start to rise more quickly I am convinced that they will reduce the monetary base. Indeed, the increase in the monetary base occurred to a relevant extent while the SNB defended the exchange rate floor. It is important to remember that they discontinued the floor stating that it was an "exceptional and temporary measure" (my emphasis).

The textbook story may be too simple, it may be wrong, it may be too "Keynesian". However, checking the textbook sometimes reveals that what we observe is actually not so puzzling.

Comments

Post a Comment