Are deflation and wage rigidities harmful? Evidence from a natural experiment

This article is based on an IRENE Working Paper and appeared on 9 February 2021 in German on Ökonomenstimme.

Many economists consider deflation, a persistent decline in the general level of prices, to be harmful for at least three reasons. First, consumers may delay important purchases in anticipation of lower prices. Second, falling prices and nominal revenues may make it more difficult to meet nominal debt obligations, causing debtors to default. Third, if workers resist nominal wage cuts, firms may resort to layoffs to cut costs when their nominal revenues fall. Most central banks aim for a clearly positive inflation target, partly as an insurance against disinflationary shocks.

During the COVID-19 pandemic inflation has fallen in most OECD countries (on average by 0.5 percentage points). Therefore, the spectre of deflation has re-emerged, which is reflected in rapid interest rate cuts and large-scale asset purchase programs.

There is little research on the harmful effects of deflation, however, and disagreement whether wage rigidities are relevant (e.g., Basu and House, 2016). Therefore, we provide novel empirical evidence on the combined effects of deflation and downward nominal wage rigidities on labour market outcomes (Funk and Kaufmann, 2020). We use a novel Swiss data set on individuals’ income, employment, and wages. The data stem from social security registers and a firm-survey. The firm-survey on wages allows us to allocate individuals into a treatment group with rigid wages, i.e. with a zero wage change in 2014, as well as into a control group with flexible wages, i.e. with a small wage cut in 2014. Because we focus on individuals close to the origin of the wage change distribution, the two groups should be similar except for the wage rigidity. We then analyse the income and employment history for individuals with a zero wage change and a small wage cut using the social security register data.

|

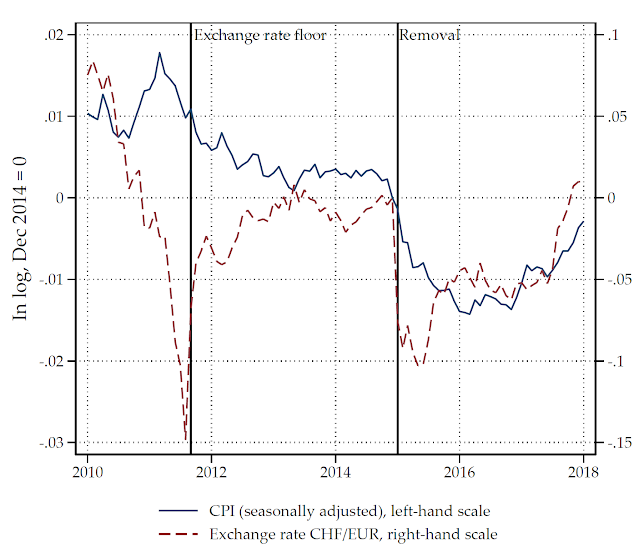

| Figure 1: Swiss exchange rate and price level |

The deflationary shock stems a surprising policy change: in January 2015 the Swiss National Bank abandoned an exchange rate floor policy leading to a 10% appreciation and a 1% decline in the price level (see Figure 1). We then examine the interaction between deflation and wage rigidities by comparing the treatment and control groups before and after the appreciation.

|

| Figure 2: Labor market outcomes individuals with wage freezes relative to small wage cuts |

We find substantial effects of downward nominal wage rigidities when the price level falls (see Figure 2). Compared to the control group, individuals with rigid wages experience a decline in income and employment income by 5% and 12%, respectively. The difference between total and employment income stems from unemployment benefits, providing an insurance of individuals’ income when becoming unemployed. This increase in unemployment benefits reflects that the probability of becoming unemployed is 1.2 percentage points higher for the treatment group.

For identification, we focus on individuals close to the origin of the wage change distribution. This implies, however, that the results are not representative for the entire economy. We therefore estimate representative aggregate effects by predicting income and employment for individuals in the treatment group in absence of wage rigidity (counterfactual prediction). We then use sampling weights to aggregate these individual predictions, along with the actual observations for individuals not in the treatment group. The effects are economically relevant for the entire economy. Compared to a counterfactual without wage rigidities, median income and employment income are 0.4% and 1% lower, respectively. In addition, the number of unemployed persons is more than 2% higher.

Our findings have implications for monetary policy and the optimal level of inflation. On the one hand, zero or slightly negative inflation is desirable because it minimizes the costs of money holdings (Friedman, 1969). In addition, deviations of inflation from zero are costly because of misallocation of resources due to relative price distortions (Yun, 2005). On the other hand, some researchers argue that the costs of positive inflation are relatively small (Nakamura et al., 2018). Moreover, positive trend inflation relaxes the effective lower bound on interest rates (see Andrade et al., 2019) and reduces distortions caused by downward nominal wage rigidities (Tobin, 1972; Kim and Ruge-Murcia, 2009). These factors have to be weighed against each other to determine the optimal level of the inflation target.

At least since the Global Financial Crisis most central bankers acknowledge that the effective lower bound is a relevant constraint. The importance of downward nominal wage rigidities for the optimal level of inflation is more controversial. Issing et al. (2003), for example, argue that “…the importance in practice of downward nominal rigidities is highly uncertain and the empirical evidence is not conclusive, particularly for the euro area.” and “…it would seem difficult to rule out the possibility that such rigidities would decline and even vanish in the context of a permanent and fully credible move to a low inflation environment.”

The Federal Reserve and the ECB have recently thoroughly reviewed their monetary policy strategies given the challenges raised during the Financial Crisis. Our findings provide new insights valuable for such strategic reviews. Downward nominal wage rigidities do not vanish even during a prolonged period of mild deflation. In addition, downward nominal wage rigidities have negative effects on income and employment after an exogenous deflationary shock. We therefore conclude that central banks and researchers should consider downward nominal wage rigidity when choosing the monetary policy strategy, in particular, the type and level of the nominal target.

References:

Andrade, P., Galí, J., Bihan, H. L., and Matheron, J. 2019. “The optimal inflation target and the natural rate of interest,” Brookings Papers on Economic Activity, 3, 173-230, https://www.brookings.edu/bpea-articles/the-optimal-inflation-target-and-the-natural-rate-of-interest

Basu, S. and House, C. L. 2016. “Allocative and remitted wages: New facts and challenges for Keynesian models,” In Taylor, J. B. and Uhlig, H., editors, Handbook of Macroeconomics, vol. 2, 297-354, Elsevier, https://doi.org/10.1016/bs.hesmac.2016.05.001.

Funk, A.K. and Kaufmann, D. 2020. “Do sticky wages matter? New evidence from matched firm-survey and register data,” IRENE Working Papers 20-06, IRENE Institute of Economic Research, University of Neuchâtel, https://ideas.repec.org/p/irn/wpaper/20-06.html.

Friedman, M. 1969. The Optimum Quantity of Money and Other Essays. Chicago: Aldine.

Issing, O., Angeloni, I., Gaspar, V., Kl¨ockers, H.-J., Masuch, K., Nicoletti-Altimari, S., Rostagno, M., and Smets, F. 2003. “Background studies for the ECB’s evaluation of its monetary policy strategy,” European Central Bank, https://www.ecb.europa.eu/press/pr/date/2003/html/pr030508_2.en.html.

Kaufmann, D. 2020. “Is deflation costly after all? The perils of erroneous historical classifications,” Journal of Applied Econometrics, 35, 614-628, https://doi.org/10.1002/jae.2762.

Kim, J. and Ruge-Murcia, F. J. 2009. “How much inflation is necessary to grease the wheels?” Journal of Monetary Economics, 56(3), 365-377, https://doi.org/10.1016/j.jmoneco.2009.03.004.

Nakamura, E., Steinsson, J., Sun, P. and Villar, D. 2018. “The elusive costs of inflation: Price dispersion during the U.S. Great Inflation,” The Quarterly Journal of Economics, 133(4), 1933-1980, https://doi.org/10.1093/qje/qjy017.

Tobin, J. 1972. “Inflation and unemployment,” American Economic Review, 62(1), 1-18.

Yun, T. 2005. “Optimal monetary policy with relative price distortions,” The American Economic Review, 95(1), 89-109, https://doi.org/10.1257/0002828053828653.

Comments

Post a Comment