Time to raise interest rates? Swiss edition

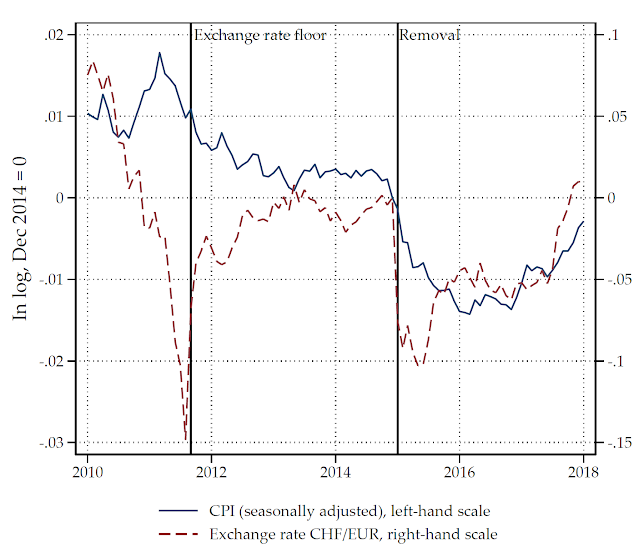

Finally, the Swiss franc has depreciated towards the value before the removal of the exchange rate floor. This is good news for the Swiss manufacturing sector (and probably for the economy as a whole) but a challenge for the Swiss National Bank. Is it time to wonder when and how the SNB will start raising interest rates, reduce its bloated balance sheet, or soak up liquidity by issuing SNB bills?

Probably, raising interest rates in Switzerland is premature. The upswing is still fragile. Domestic inflation is now at 0.4%, core inflation at 0.6%. Although inflation is within the SNB's definition of price stability risks are asymmetrically distributed. Short-term rates are still constrained by a (slightly below zero) lower bound. Moreover, equilibrium interest rates worldwide have fallen, which limits the ability of central banks to raise nominal interest rates. This is an even more serious constraint for the SNB because of the historically low inflation rate. The SNB has currently much less space to respond if the economy slows down than if the economy suddenly improves. Finally, the unemployment rate stands at 4.8% (ILO definition), 1pp above that in Germany.

Unfortunately, all these facts are pushed to the background because the focus stays on whether the exchange rate is above or below 1.20 CHF/EUR. Is this the "fair value" of the Swiss franc? Is it overvalued or undervalued? We don't know. We only know that the governing board thinks that it is still to early to change course because it does not want to "provoke an appreciation of the Swiss franc" as the "the situation remains fragile in the foreign exchange market".

Although, a more detailed account also mentions that low interest rates are necessary to keep prices stable and support the economy, the constant focus on the exchange rate is unfortunate. First, it reinforces the impression that the exchange rate interventions were mostly aimed at helping the export industry. Second, it creates an expectation that the SNB will raise rates only if the ECB will make a move. Third, the justification is only weakly related to the SNB's mandate.

A good example how to exit an exchange rate policy delivers the Czech National Bank. Recall that they introduced an exchange rate target vis-à-vis the euro because interest rates were constrained by the zero lower bound. They defended this level until April 2017 when the inflation rate rose slightly above their point target of 2%. Then, they decided to remove the peg not because of the exchange rate as such, but, because it was time to tighten policy. Meanwhile, they increased short-term rates several times even though the ECB kept interest rates low. As a consequence, the koruna actually appreciated against the euro. However, this appreciation is a welcome tightening of policy. It turns out that their economy is booming and wages are on the rise.

The experience of the Czech National Bank shows that robust inflation and a booming domestic economy allows to raise policy rates and even stomach and appreciation.

Probably, raising interest rates in Switzerland is premature. The upswing is still fragile. Domestic inflation is now at 0.4%, core inflation at 0.6%. Although inflation is within the SNB's definition of price stability risks are asymmetrically distributed. Short-term rates are still constrained by a (slightly below zero) lower bound. Moreover, equilibrium interest rates worldwide have fallen, which limits the ability of central banks to raise nominal interest rates. This is an even more serious constraint for the SNB because of the historically low inflation rate. The SNB has currently much less space to respond if the economy slows down than if the economy suddenly improves. Finally, the unemployment rate stands at 4.8% (ILO definition), 1pp above that in Germany.

Unfortunately, all these facts are pushed to the background because the focus stays on whether the exchange rate is above or below 1.20 CHF/EUR. Is this the "fair value" of the Swiss franc? Is it overvalued or undervalued? We don't know. We only know that the governing board thinks that it is still to early to change course because it does not want to "provoke an appreciation of the Swiss franc" as the "the situation remains fragile in the foreign exchange market".

Although, a more detailed account also mentions that low interest rates are necessary to keep prices stable and support the economy, the constant focus on the exchange rate is unfortunate. First, it reinforces the impression that the exchange rate interventions were mostly aimed at helping the export industry. Second, it creates an expectation that the SNB will raise rates only if the ECB will make a move. Third, the justification is only weakly related to the SNB's mandate.

A good example how to exit an exchange rate policy delivers the Czech National Bank. Recall that they introduced an exchange rate target vis-à-vis the euro because interest rates were constrained by the zero lower bound. They defended this level until April 2017 when the inflation rate rose slightly above their point target of 2%. Then, they decided to remove the peg not because of the exchange rate as such, but, because it was time to tighten policy. Meanwhile, they increased short-term rates several times even though the ECB kept interest rates low. As a consequence, the koruna actually appreciated against the euro. However, this appreciation is a welcome tightening of policy. It turns out that their economy is booming and wages are on the rise.

The experience of the Czech National Bank shows that robust inflation and a booming domestic economy allows to raise policy rates and even stomach and appreciation.

Comments

Post a Comment