Monetary policy during the Covid-19 crisis: What challenges lie ahead for the Swiss National Bank?

This article originally appeared in french in Le Temps on 4 January 2020

The Pandemic caused severe recessions in Switzerland and abroad. Although the Swiss economy rebounded strongly in the third quarter, an uncertain health and economic outlook, as well as dwindling foreign demand keep economic activity below its pre-crisis level. The worsening health situation in the fourth quarter, along with the state-mandated closures of businesses, further delay the recovery.

The peculiarity of the economic impact of the pandemic should be reflected in the policy response. Many economists agree: firms should be generously compensated by fiscal authorities if they are subject to state-mandated closures. In addition, extended or even more generous short-term work can provide a lifeline until the health situation is under control; unemployment insurance can guarantee an income if workers still lose their jobs. These examples show that fiscal policy and automatic stabilizers take center stage to deal with the economic fallout. However, monetary policy can and should contribute as well.

So far, the Swiss National Bank (SNB) has been active in three areas. First, it provided additional liquidity to money markets because interest rates creeped upwards spring. The reason for this undesirable development was a technical adjustment by the SNB to reduce the burden of negative interest rates for commercial banks. These liquidity provisions moved money market rates closer to the SNB’s interest rate target of -0.75%. Second, the SNB stepped up its foreign exchange interventions to counter an excessive appreciation of the Swiss franc. This led to a further increase in its foreign currency investments and its balance sheet. Third, it provided liquidity to commercial banks in exchange for government-backed loans to SME’s (Covid-19 credits). This ensured that commercial banks did not run into liquidity constraints when granting Covid-19 credits.

These measures illustrate that the SNB faces limits with its current monetary policy strategy. The SNB did not lower its target interest rate, which is the normal response during a recession, presumably because it fears effects deeply negative interest rates have on financial stability. The foreign exchange interventions did not weaken the Swiss franc. Instead, the United States labelled Switzerland a currency manipulator. This may trigger tariffs on Swiss exports down the road. Finally, the key ingredient of the Covid-19 credit program was a guarantee by the Swiss Confederation. The SNB had no direct influence on the volume or the conditions of the credits.

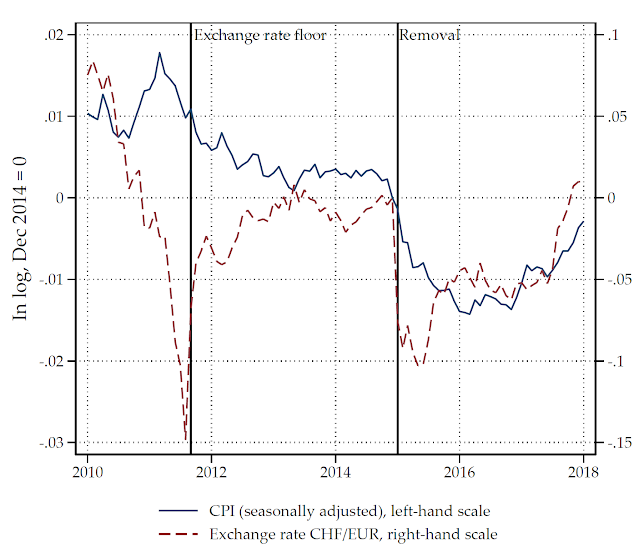

Because of these limits, the SNB does not respond to economic downturns as aggressively as it needs to. Therefore, inflation (the growth rate of the general price level) has been on average too low since the Financial Crisis. The SNB defines price stability as an inflation rate between 0% and 2%. Deflation, that is a sustained decline in the price level, is not in line with the SNB’s mandate. Before the Financial Crisis, inflation averaged 1% per year. Since then, inflation fell to slightly negative territory. This mild deflation traps the SNB in a vicious circle. Low inflation leads to low nominal interest rates, which limits how strongly the SNB can lower its interest rate target during a recession. Because interest rates do not fall during a recession, the Swiss franc becomes more attractive compared to foreign currencies, which leads to an appreciation. Therefore, the SNB must use foreign exchange interventions to avoid an excessive appreciation. Because the SNB is not willing to offset the full appreciation, prices tend to fall as firms try to offset the loss in competitiveness. And so, the circle continues.

But why is deflation harmful at all? This is best illustrated with an example. The revenue of a bakery is determined by how many breads it sells and the price it charges. It uses these revenues to pay salaries, buy flour, and repay a loan. A decline in demand during a recession causes a fall in the number of breads it sells. Because of the reduction of its revenues, it becomes more difficult to cover its costs. The bakery may resort to layoffs to reduce its costs or even go bankrupt. The impact of deflation is more subtle. A general decline in the price level reduces the revenues of the bakery as well. At the same time, the price of flour and bread are lower than what they would have been. However, employment and debt contracts usually specify the amount that must be paid and cannot be easily renegotiated. Therefore, the bakery will also find it more difficult to pay the salaries and repay its loan.

The Financial Crisis has clearly outlined the limits to monetary policy. While the SNB is by no means the only central bank grappling with the low-interest rate and low-inflation environment one wonders whether this issue is taken seriously enough. The European Central Bank, for example, has publicly called for a more active fiscal policy. Another solution are novel monetary policy strategies that relax these limits. The Federal Reserve, the central bank of the United States, has already introduced a new strategy in which it promises to let prices increase more strongly after a severe recession. The goal of this strategy is to convince firms and their creditors that their revenues will quickly rise once the crisis is over. If this announcement is credible, everybody will be more optimistic that firms will meet their obligations. Therefore, firms may shed fewer jobs and will less likely default.

Whether such novel strategies work in practice is still an open question. The SNB’s current monetary policy strategy, introduced in 2000, has worked relatively well for the first 10 years. Afterwards, however, it is at least partly responsible for low inflation, low interest rates, and a massive increase of the SNB’s balance sheet. A through review, possibly engaging academics and the public, would not only force the SNB to rethink its strategy, but also foster the public’s trust in this important Swiss institution.

Comments

Post a Comment