A long-run view on monetary policy - Part 4: Do central banks control inflation?

This is Part 4 of a series of articles on Swiss monetary policy I wrote jointly with Simon Schmid for Republik. They kindly agreed that I can publish an english version on my blog. Enjoy:

In this series we attempt to shed light on how the monetary environment changed over the last 100 plus years. After describing the long-run trends in inflation, interest rates and monetary aggregates we are slowly but surely getting at the important but probably more controversial questions: What can central banks achieve and how should they achieve it.

This part sheds once more some light on inflation developments and asks whether central banks can still influence inflation in a highly globalized environment. We ask: does inflation in a small open economy depend mostly on foreign developments?

This is indeed what we observe. Switzerland, with a very low inflation target of 0%-2% (we display the midpoint in the chart) has the lowest average inflation rate. Meanwhile, Turkey has a higher inflation target and also a higher inflation rate. The R-squared statistic measures how much of the differences between the inflation rate can be traced back to differences in the inflation target: more than 80%.

In this series we attempt to shed light on how the monetary environment changed over the last 100 plus years. After describing the long-run trends in inflation, interest rates and monetary aggregates we are slowly but surely getting at the important but probably more controversial questions: What can central banks achieve and how should they achieve it.

This part sheds once more some light on inflation developments and asks whether central banks can still influence inflation in a highly globalized environment. We ask: does inflation in a small open economy depend mostly on foreign developments?

Mistakes and lessons learned after the Bretton-Woods era

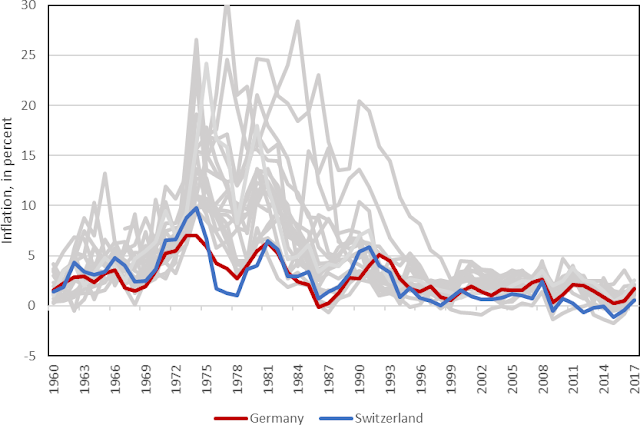

Let's first look at some data. The figure shows annual inflation in 19 countries since 1960. During the Bretton-Woods era, inflation was similar in all countries. This is not surprising since fixed exchange rates implied that medium- to long-run inflation developments had to be similar: there was no or little room for an independent monetary policy.

Figure 1: Stable and volatile Inflation developments in OECD countries

|

| Source: OECD. The unnamed grey lines display Australia, Austria, Belgium, Canada, Finland, France, Greece, Italy, Japan, Luxembourg, New Zealand, Norway, Portugal, Spain, Sweden, United States, and the United Kingdom. |

With the break-up of the system in the early 1970s central banks had more room and flexibility to conduct an independent monetary policy. And, indeed, they used this flexibility. Inflation rates started to differ dramatically. While Switzerland and Germany achieved relatively low and stable inflation, many other countries experienced inflation rates above 10%. Only in the course of the 1990s we observe a stabilization.

Sometimes, we read that globalization, global value chains, and price pressures from China are mostly responsible for the current low and stable inflation rates. The differing evolution before the 2000s suggests otherwise. Apparently, central banks made serious mistakes after the Bretton-Woods era. Afterward, they learned their lessons and achieved relatively low inflation rates once they learned how to deal with (somewhat) flexible exchange rates.

This is also supported by the observation that some countries, especially Germany and Switzerland, fared relatively well during the 1970s and 80s. Interestingly, medium-term inflation did not differ systematically between the two countries before the introduction of the euro. For Switzerland, as a small open economy, the swings were somewhat more pronounced. But on average, inflation was practically identical in the two countries. After the introduction of the euro, however, inflation was on average systematically higher in Germany than in Switzerland. The natural interpretation is that Switzerland has in principle a similar inflation aversion than Germany. But, once the euro was introduced, German monetary policy was delegated to the ECB that aims for a somewhat higher inflation target than Switzerland (close to 2% vs. 0%-2%).

This is also supported by the observation that some countries, especially Germany and Switzerland, fared relatively well during the 1970s and 80s. Interestingly, medium-term inflation did not differ systematically between the two countries before the introduction of the euro. For Switzerland, as a small open economy, the swings were somewhat more pronounced. But on average, inflation was practically identical in the two countries. After the introduction of the euro, however, inflation was on average systematically higher in Germany than in Switzerland. The natural interpretation is that Switzerland has in principle a similar inflation aversion than Germany. But, once the euro was introduced, German monetary policy was delegated to the ECB that aims for a somewhat higher inflation target than Switzerland (close to 2% vs. 0%-2%).

Of course, this difference is relatively small. Is there more evidence that central banks can independently control inflation?

Global and domestic inflation

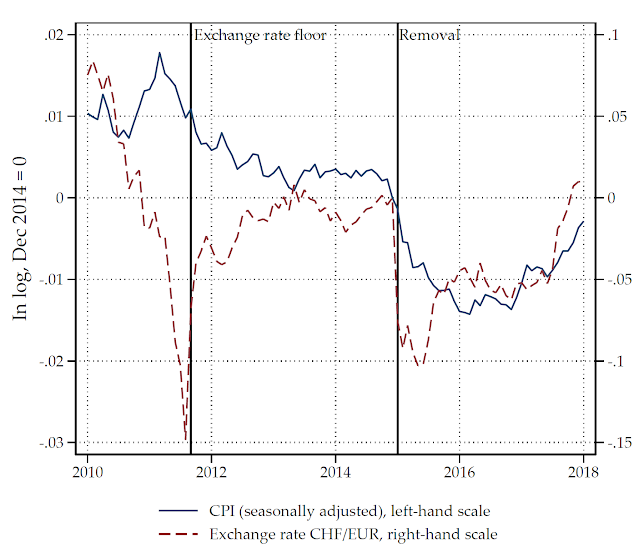

To show that inflation is not only a monetary but also a domestic phenomenon we can have a look at the correlation between inflation in Switzerland and the G-7 countries. This statistic equals 1 if the two inflation rates always move in the same direction and -1 if they move in the opposite direction. It is zero if there is no relationship. In addition, we show the correlation for various time periods and for actual and core inflation. The latter excludes volatile prices for food and energy.

Figure 2: Little relationship between Swiss and G-7 core inflation

|

| Source: OECD. Inflation rates are calculated with quarterly data compared to the same quarter in the previous year. The sample ranges from 1973-2017. |

Actual Swiss inflation is indeed highly correlated with inflation in the G-7 countries. The correlation coefficient amounts up to 0.8 suggesting that increasing G-7 inflation was almost always associated with increasing Swiss inflation (and vice versa). The reason is indeed that Switzerland is a small open economy that is affected by international price fluctuations (one quarter of the CPI basket consists of imported products). In addition, these price fluctuations are often large (for example for oil products). However, these price fluctuations usually only have a temporary impact on CPI inflation in Switzerland, which is the reason why central bank should actually ignore them.

It seems to be the case that this is indeed what the Swiss National Bank does. If we calculate the correlation for core inflation, excluding volatile food and energy price fluctuations, the correlation is much lower and, after 2008, roughly zero. This strongly suggests that the Swiss National Bank has an influence over inflation developments in the medium term, once short-term fluctuations in volatile prices faded out (Thomas Jordan made a similar point in speech in 2015).

Inflation targets and inflation rates

So far, we have two pieces of evidence that central banks can influence domestic inflation in the medium-run: diverging inflation developments after the Bretton-Woods era and only a weak relationship between Swiss and foreign core inflation. As a last piece of evidence, we have a look at the inflation targets central banks set (or are mandated to achieve) and the subsequent average inflation development. Our hypothesis is that central banks with a high inflation target should achieve a high inflation rate and vice versa.

For this reason, we assembled data on the inflation targets for 40 countries and compare them with the actual average inflation rate since 2012. We would expect a positive relationship between the two.

Figure 3: Low inflation targets associated with low average inflation

|

| Source: OECD; Gill Hammond (2012): "State of the At of Inflation Targeting"; IMF (2006): "Inflation Targeting and the IMF"; websites of various central banks. |

This is indeed what we observe. Switzerland, with a very low inflation target of 0%-2% (we display the midpoint in the chart) has the lowest average inflation rate. Meanwhile, Turkey has a higher inflation target and also a higher inflation rate. The R-squared statistic measures how much of the differences between the inflation rate can be traced back to differences in the inflation target: more than 80%.

Of course, this does not necessarily imply that Turkey could introduce a 0% inflation target and then inflation would immediately drop to this level. The latest developments indeed show that an inflation target is not sufficient to keep inflation down: in the past months, Turkey's currency devalued strongly and inflation rose to more than 25%. One of the reasons is that the President pressured the central bank to keep interest rates down raising doubts by investors about the stability of the currency.

This example shows that a central bank can only achieve its target if it has the support of the public institutions and the public at large. The inflation target, whether it is set by the central bank or by the government, is then the result of a broad consensus that low inflation is desirable and valuable. This consensus will depend on factors beyond the influence of the central bank such as the general inflation aversion of the public, political stability, and the efficiency of the tax system. But also, the example shows that monetary policy can create inflation independent of globalization trends and price pressures from China.

Conclusion

What can a central bank achieve? We touched on two different stories:

First, central banks have little influence over domestic inflation because of globalization, global value chains, and international inflation trends. Second, central banks control medium-term inflation astonishingly well. But, whether inflation is low and stable or high and volatile depends not only on the central bank but also the mandate the government defines and the general political environment.

The data in this article strongly support the second story. Indeed, the Swiss National Bank succeeded to provide a low and stable inflation rate in a sometimes volatile international environment. In part, this can be traced back to the strategies the Swiss National Bank adopted. Whether the current strategy is still a good fit for the future will be the topic of the last part of the series.

Comments

Post a Comment