(Mis)understanding the SNB's inflation forecast

Is the SNB good at forecasting inflation? Some commentators think: no. When we compare past inflation forecasts by the SNB with realized inflation they do not appear very accurate. This point of view is false and based on a common misunderstanding about the nature and purpose of this forecast. And no, this is not because macroeconomic forecasts are generally quite imprecise (full disclaimer: I worked at the SNB's inflation forecasting unit for some time).

Let us first talk about what the forecast does not show. It does not give the SNB's best assessment about the likely future evolution of inflation. The SNB's best assesssment is probably quite uninteresting: why should a central bank officially forecast that it fails to keep inflation in line with its mandate (in Switzerland a range of 0-2% CPI inflation)? Therefore, a central bank inflation forecast about the most likely evolution of inflation does not contain much information about monetary policy as such.

What the SNB inflation forecast shows is the likely evolution of inflation with an unchanged policy instrument (the 3M Libor interest rate). It is, in central banking slang, a conditional forecast. It therefore shows the evolution of future inflation if the SNB, for some reason, would not respond with the necessary interest rate changes to keep inflation in line with price stability. Therefore, a forecast rising above 2% (or below 0%) indicates that the SNB will likely raise (or lower) interest rates. Because failing to do so would endanger price stability. It is therefore mainly a communication tool about the likely future evolution of interest rates, not the inflation rate.

So what would we expect the SNB forecast to look like. First, note that if the SNB fulfills its price stability mandate, the CPI inflation rate should remain in (or not deviate too much for too long from) the 0-2% price stability range. So independent from the SNB's forecast, inflation should remain low and stable. Second, if the forecast actually gives a good indication about necessary interest rate changes, the conditional forecast should often deviate from the price stability range. Because only if this is the case, the SNB gives an accurate signal to the public that interest rates will change soon. As a consequence, evaluating this conditional forecast with the actually realized inflation rate does not make any sense. A proposal how to evaluate the usefulness of this forecast can be found here.

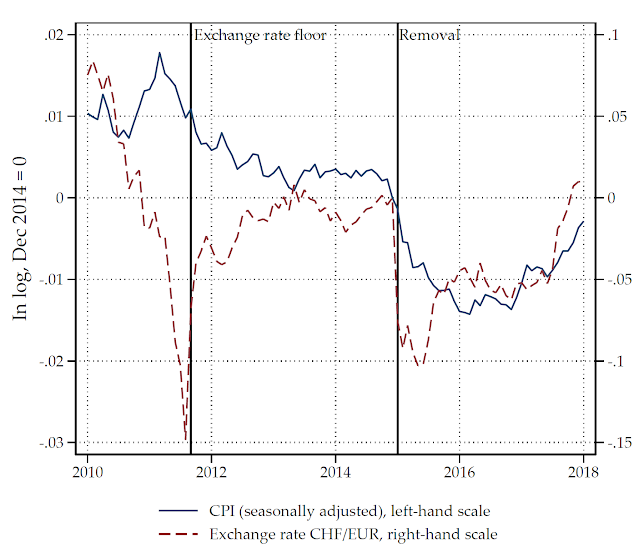

Put differently, if the SNB makes a good job we should observe a stable actual inflation rate but substantial changes in the interest rate to keep inflation stable. If the conditional forecast is a good signal for these interest rate changes, it should of course change as well.

This is complicated. In my opinion, too complicated. Besides journal articles such as the one linked at the beginning of this post, there are research papers evaluating the SNB's forecast in a similar way. If even economic commentators and researchers do not get the point of a conditional forecast, who does? It would be easier to directly communicate future interest rate changes by publishing an interest rate forecast as other central banks do. However, the conditional forecast gives the SNB some wiggle room because it does not want to directly shape expectations about future interest rate changes, only give a fuzzy hint.

PS: Maybe this analogy helps to illustrate the point. Suppose you are driving a Tesla with its autopilot technology. The sensors detect whether you approach a curve and the system automatically turns the steering wheel if you fail to do so. Suppose the autopilot works and you do not touch the steering wheel. Our best forecast for the car's route is that it will closely follow the street. Now, suppose that the autopilot is broken. Of course we would predict that, if you do not touch the steering wheel, the car will crash into the guard railing.

Let us first talk about what the forecast does not show. It does not give the SNB's best assessment about the likely future evolution of inflation. The SNB's best assesssment is probably quite uninteresting: why should a central bank officially forecast that it fails to keep inflation in line with its mandate (in Switzerland a range of 0-2% CPI inflation)? Therefore, a central bank inflation forecast about the most likely evolution of inflation does not contain much information about monetary policy as such.

What the SNB inflation forecast shows is the likely evolution of inflation with an unchanged policy instrument (the 3M Libor interest rate). It is, in central banking slang, a conditional forecast. It therefore shows the evolution of future inflation if the SNB, for some reason, would not respond with the necessary interest rate changes to keep inflation in line with price stability. Therefore, a forecast rising above 2% (or below 0%) indicates that the SNB will likely raise (or lower) interest rates. Because failing to do so would endanger price stability. It is therefore mainly a communication tool about the likely future evolution of interest rates, not the inflation rate.

So what would we expect the SNB forecast to look like. First, note that if the SNB fulfills its price stability mandate, the CPI inflation rate should remain in (or not deviate too much for too long from) the 0-2% price stability range. So independent from the SNB's forecast, inflation should remain low and stable. Second, if the forecast actually gives a good indication about necessary interest rate changes, the conditional forecast should often deviate from the price stability range. Because only if this is the case, the SNB gives an accurate signal to the public that interest rates will change soon. As a consequence, evaluating this conditional forecast with the actually realized inflation rate does not make any sense. A proposal how to evaluate the usefulness of this forecast can be found here.

Put differently, if the SNB makes a good job we should observe a stable actual inflation rate but substantial changes in the interest rate to keep inflation stable. If the conditional forecast is a good signal for these interest rate changes, it should of course change as well.

This is complicated. In my opinion, too complicated. Besides journal articles such as the one linked at the beginning of this post, there are research papers evaluating the SNB's forecast in a similar way. If even economic commentators and researchers do not get the point of a conditional forecast, who does? It would be easier to directly communicate future interest rate changes by publishing an interest rate forecast as other central banks do. However, the conditional forecast gives the SNB some wiggle room because it does not want to directly shape expectations about future interest rate changes, only give a fuzzy hint.

PS: Maybe this analogy helps to illustrate the point. Suppose you are driving a Tesla with its autopilot technology. The sensors detect whether you approach a curve and the system automatically turns the steering wheel if you fail to do so. Suppose the autopilot works and you do not touch the steering wheel. Our best forecast for the car's route is that it will closely follow the street. Now, suppose that the autopilot is broken. Of course we would predict that, if you do not touch the steering wheel, the car will crash into the guard railing.

That's exactly it: "However, the conditional forecast gives the SNB some wiggle room because it does not want to directly shape expectations about future interest rate changes, only give a fuzzy hint." According to the SNB, inflation will (conditionally) always pick up significantly in the near future. The conditional forecasts are thus simply for scaring the public into accepting whatever policy the SNB wants to implement because it will do it for taming otherwise unavoidable inflation. Does that look like a trustworthy strategy?

ReplyDeleteLuckily, the SNB depends completely on the ECB policy. It is therefore spared the challenge of actually conducting monetary policy.

Using the Tesla analogy I added in the post: it is indeed scary to think about what would happen if the autopilot stopped working (the car would crash). I am sympathetic to your view that it is not necessary to communicate in this way.

DeleteBTW: This is the first comment on this blog. So thank you very much for getting in touch!