What does the SNB's inflation forecast tell us about policy rates?

Recall that the SNB's mandate is, as a first priority, to preserve price stability. As a second priority the SNB can engage in business cycle stabilization and can "contribute" to financial stability. The SNB itself defines price stability as an annual inflation rate of between 0% and 2% in the medium term, which is also the definition mentioned in the dispatch to the National Bank Act. Clearly, the SNB cannot change this mandate given by the legislator; therefore, the SNB's interest rate decisions have to be consistent with this mandate.

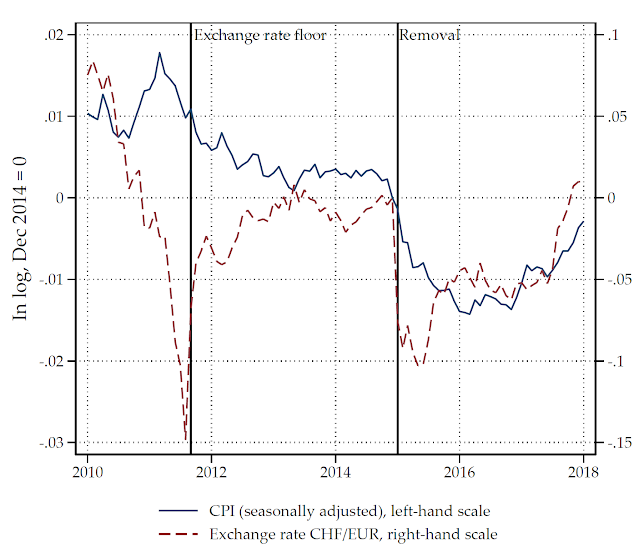

This does not mean, however, that the CPI inflation rate always has to stay within the target range. The SNB allows temporary deviations caused, for example, by one-off oil price or exchange rate fluctuations (this is what "in the medium term" means). To judge whether a deviation from the target range is temporary or permanent, the SNB's economists produce a conditional inflation forecast. The forecast takes into account a range of models, indicators, surveys, and judgement, of a large group of economists. The idea is to communicate whether, given the current level of the policy interest rate, inflation will remain within the target range. If this is the case, the policy interest rate is at an appropriate level. If inflation is too high (or too low), this signals that the SNB considers a change in the interest rate.

The figure shows the SNB's conditional inflation forecasts over time together with the actual CPI inflation rate. We see that, usually, the forecast is increasing. But increases above 2% were relatively rare over the last 10 years. Of course, the subdued conditional inflation forecast stems partly from the financial crisis, but also, from some policy decisions taken by the SNB (this is a topic for another post).

|

| Figure 1: SNB's conditional inflation forecasts (in blue) and actual CPI inflation (in red). Source: SNB. |

If we want to judge whether the SNB is about to raise interest rates we have to look at the end of its inflation forecast because the mandate requires price stability only over the medium term. The next figure shows how the endpoint of the forecast published in a particular quarter evolved relative to the upper price stability range (2%). In addition, the blue bars show the change in the SNB's policy interest rate. We see that an inflation forecast of around 2% and higher was associated with interest rate increases from 2004-2007. Then, the inflation forecast collapsed during the financial crisis followed by a substantial reduction in the policy interest rate (note that rate cuts between official meetings are accumulated in the bars). The period from 2010-2011 shows, however, that the SNB does not mechanically raise interest rates when its forecast raises above 2%. Finally, from Fall 2011 to 2017, the forecast endpoint stayed always below 2% suggesting that no interest rate increases were in sight.

|

Figure 2: Endpoint of the SNB's conditional inflation forecast published in the corresponding quarter (in red), the change in the policy interest rate announced in the corresponding quarter (in blue), and the upper target range (2%). Source: SNB.

|

Currently, however, the endpoint of the inflation forecast hovers around 2%. So does this signal that the SNB is about to raise interest rates? I don't think so, for four reasons. First, we have seen that even in the past, rate increases do not necessarily have to occur when the endpoint raises above 2%. Second, there is a technical pecularity that the SNB publishes its forecast based on the policy interest rate after an interest rate decision. This means that, if the SNB would increase the policy rate today, the conditional inflation forecast would fall below 2%. Third, I expect that the SNB will let the conditional inflation forecast raise clearly above 2% before starting a tightening cycle. The reason is that increasing the policy rate for the first time signals that more rate increases are about to happen; therefore, the first rate increase may have a much stronger effect on the economy and the exchange rate than subsequent rate increases that are already priced in. Fourth, given that there is only a small risk to price stability, the SNB can take into account its second priority: the real economy. But, the Swiss economy seems to cool down, which makes an interest rate increase even less likely.

In sum, the SNB's inflation forecast gives little evidence that the SNB will raise rates soon.

Comments

Post a Comment