Why are Swiss interest rates so low?

Why are Swiss interest rates lower than euro area interest rates? One explanation is that Swiss interest rates are lower because Swiss assets are less risky than euro area assets. Switzerland therefore benefits from an interest rate bonus. This is also one justification that is regularly mentioned why Swiss interest rates have to be lower than in the euro area in order to avoid an unwelcome appreciation.

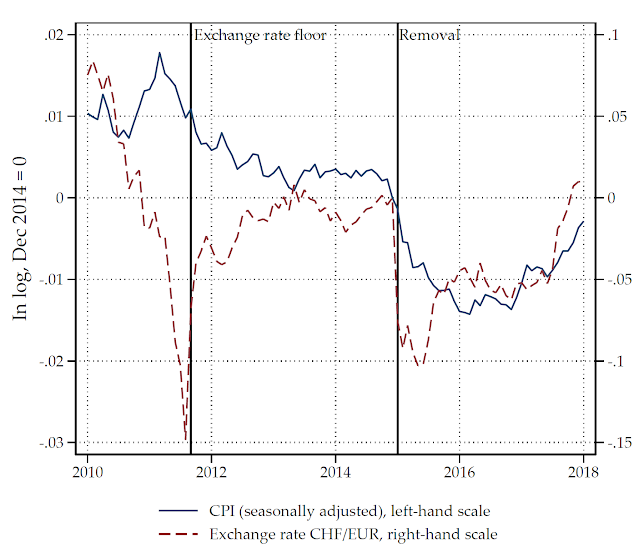

If central banks introduce an inflation target, inflation expectations often hover around these values. In central bank lingo: expectations are firmly anchored. For Switzerland, the inflation target is a range between 0-2%. For the euro area, the inflation target is close to, but, below 2%. Although this seems to be a minor difference, it is highly relevant in practice. Over the past 20 years, inflation was usually lower in Switzerland than in the euro area. The figure shows that before the financial crisis, inflation was on average about 1.5pp lower (the blue line shows the difference between inflation in Switzerland and the euro area). At the same time, the nominal interest rate in Switzerland was about 1.5pp-2pp lower than in the euro area (red line). This suggests that the main explanation for the lower Swiss interest rate is the lower inflation target rather than a risk premium. After the financial crisis, the inflation differential became more negative while the interest rate differential remained roughly constant. This reflects that the zero lower bound constrained further interest rate cuts by the SNB. But at the same time, the appreciation wave of 2010 reduced the inflation rate in Switzerland relative to the euro area. After this period, we see that the inflation differential is again roughly in line with the interest rate differential. Thus, most periods are in line with the idea that the short-term real interest rate is about the same in Switzerland and the euro area and the difference is not justified by a risk premium.

Rarely do we read, however, that the Swiss National Bank's inflation target is responsible for the difference between Swiss and euro area interest rates. Note that the nominal interest rate is essentially the sum of the real interest rate and inflation expectations (the Fisher equation). Therefore, low nominal interest rates could stem from low real interest rates (including a risk premium) or low inflation expectations. This implies that, if inflation expectations in Switzerland are lower than in the euro area, nominal interest rates tend to be lower as well.

|

| Notes. CHF 3M Libor -- EUR 3M Libor (red line) and Swiss CPI inflation -- Euro area CPI inflation (blue line) |

If central banks introduce an inflation target, inflation expectations often hover around these values. In central bank lingo: expectations are firmly anchored. For Switzerland, the inflation target is a range between 0-2%. For the euro area, the inflation target is close to, but, below 2%. Although this seems to be a minor difference, it is highly relevant in practice. Over the past 20 years, inflation was usually lower in Switzerland than in the euro area. The figure shows that before the financial crisis, inflation was on average about 1.5pp lower (the blue line shows the difference between inflation in Switzerland and the euro area). At the same time, the nominal interest rate in Switzerland was about 1.5pp-2pp lower than in the euro area (red line). This suggests that the main explanation for the lower Swiss interest rate is the lower inflation target rather than a risk premium. After the financial crisis, the inflation differential became more negative while the interest rate differential remained roughly constant. This reflects that the zero lower bound constrained further interest rate cuts by the SNB. But at the same time, the appreciation wave of 2010 reduced the inflation rate in Switzerland relative to the euro area. After this period, we see that the inflation differential is again roughly in line with the interest rate differential. Thus, most periods are in line with the idea that the short-term real interest rate is about the same in Switzerland and the euro area and the difference is not justified by a risk premium.

This is of course relevant for monetary policy. Because of the lower inflation target it is more likely that interest rates have to be low or negative in a downturn or when the Swiss franc appreciates. As a consequence, a lower inflation target has costs that are rarely discussed in Switzerland and we mostly hear only about the benefits.

Comments

Post a Comment